How Much Does Ebay Take

The Global Shipping Program places restrictions on the size and weight of items that are available for international shipping. This is to ensure that international delivery can be completed on all GSP items. In addition, all GSP items must be physically located in the United States in order to qualify for the Program. Any items that you send to the Global Shipping Center from an address outside of the United States will be processed as undeliverable items, as described below.

Make the most of selling on eBay - read our 47 eBay selling tactics to help you list auctions effectively, smash down eBay seller fees and make money. How to sell on eBay: 47 eBay selling tips - MSE We use cookies to make the site easier to use.

GSP items are also subject to the import/export laws of the buyer's country of residence. In addition, illegal or hazardous items cannot be sent via the Global Shipping Program.

eBay reserves the right to alter or amend the eligibility requirements for items under the Program at any time, with or without notice. This includes, (but is not limited to), limits on the number, type, category, and/or value of items or transactions. You agree not to sell any ineligible items through the Program. Other restrictions apply. Click here for more information and a complete list of restricted items and categories.

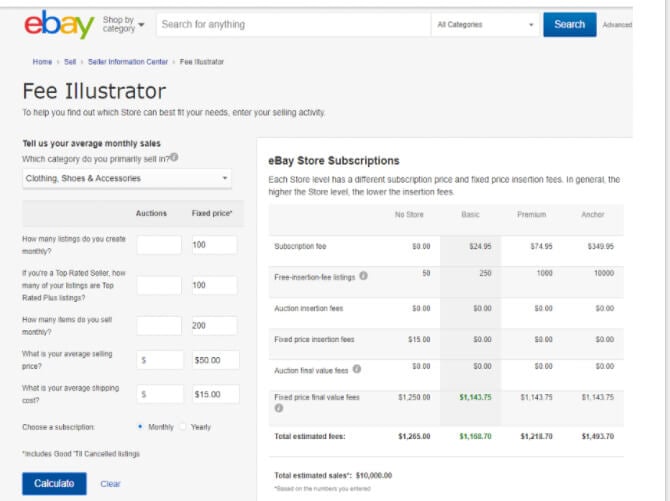

How Much Does Ebay Take In Fees

Are you a buyer looking for information about tax? Read our article about paying tax on your eBay purchases

Sellers' tax responsibilities

You are responsible for paying all fees and taxes associated with using eBay as an eBay seller. For more information on eBay's tax policy and your obligations, see our Tax policy and User Agreement.

Your tax-related responsibilities may include:

- Paying sales tax on eBay sales

- Paying income tax on eBay sales

- Informing overseas buyers about import charges

The Supreme Court ruled in favor of South Dakota - opens in new window or tab in June 2018, which removed the requirement that certain retailers have a physical presence in a state in order for that state to impose sales tax obligations on retailers. Regardless of where you're physically located, if you do business in certain states, those states may require you to collect applicable taxes on your transactions.

For more information on these new tax requirements, we recommend that you consult with your tax advisor. If you do not have a tax advisor, you may want to reach out to Avalara - opens in new window or tab and/or TaxJar - opens in new window or tab.

Charging sales tax on eBay sales

If you're required to charge sales tax, you can set up a tax table and apply it to your listings. We'll then add the tax to the buyer's total at checkout. You're responsible for paying the sales tax to the appropriate authority.

Contact a tax professional to determine whether you need to charge sales tax on your eBay sales, or if you have questions about any other taxes. We can't provide tax advice or guarantee that our sales tax features meet all tax requirements.

Setting up a tax table

You can specify a sales tax rate for each US state in which you're required to charge sales tax. You can also charge tax on shipping and handling, if it's required by law.

Buyers see your tax rates on the listing page. Once they confirm their shipping address at checkout, we automatically calculate the sales tax amount and add it to their order total.

Lord of the Rings: The Third Age delivers a massive RPG based in Tolkien's world of Middle Earth. Third age total war guide. But now it is finally here. Rather than playing through a story you already know, this game tells you the story behind the story. The Third Age delves deeper into the story of the One Ring. You'll run into some old friends, such as Gandalf and Aragorn along the way, but mostly will play as a lesser-known group of heroes.

Here's how to set up your tax table:

- Go to Site Preferences - opens in new window or tab in the Account section of My eBay.

- In the Payments from buyers section, select Show.

- Select Edit in the Use sales tax table section.

- Fill in the sales tax rate for any state where you want to charge sales tax. If you're also required to tax shipping and handling in that state, select the Also charge sales tax on S&H check box.

- Select Save.

Important things to keep in mind when setting up a tax table:

- When you list your item you need to indicate that you charge sales tax in the listing form and associate your tax table with the listing.

- Changes that you make to your tax table won't be reflected in your live listings. You will need to revise any current active listings in order for your tax table changes to apply to those listings. Listing created after you have saved your tax table changes will reflect your tax table updates.

Once you've created your tax table, you need to specify in your listing that you are charging sales tax. Here's how:

- On the listing form, check the box beside Charge sales tax according to the sales tax table.

- You can open and make changes to your tax table by selecting View sales tax table.

- Complete your listing and select Preview listing or Save and continue later.

eBay sales tax collection

Based on applicable tax laws, eBay will calculate, collect, and remit sales tax on behalf of sellers for items shipped to customers in the following states:

State | Effective Date | Additional Information |

Minnesota | January 1, 2019 | Small business exemption - Minnesota has enacted a small business exemption for out of state unregistered sellers whose taxable retail sales into Minnesota are less than $10,000 in the previous 12-month period. These sellers are not subject to the Minnesota marketplace tax laws, and eBay will not be collecting sales tax on these transactions. |

Washington | January 1, 2019 | |

Iowa | February 1, 2019 | |

Connecticut | April 1, 2019 | |

District of Columbia | May 1, 2019 | |

Nebraska | May 1, 2019 | |

New Jersey | May 1, 2019 | |

Idaho | June 1, 2019 | |

New York | June 1, 2019 | |

Alabama | July 1, 2019 | |

Arkansas | July 1, 2019 | |

Indiana | July 1, 2019 | Please contact the Department of Revenue - opens in new window or tab for further information. |

Kentucky | July 1, 2019 | |

New Mexico | July 1, 2019 | Please contact the Taxation and Revenue Department - opens in new window or tab for further information. |

Oklahoma | July 1, 2019 | |

Pennsylvania | July 1, 2019 | |

Rhode Island | July 1, 2019 | Please contact the Division of Taxation - opens in new window or tab for further information. |

South Dakota | July 1, 2019 | |

Virginia | July 1, 2019 | |

West Virginia | July 1, 2019 | |

Wyoming | July 1, 2019 | |

Vermont | July 1, 2019 | |

California | October 1, 2019 | Please contact the Department of Tax and Fee Administration - opens in new window or tab for further information. |

North Dakota | October 1, 2019 | Please contact the Office of State Tax Commissioner - opens in new window or tab for further information. |

South Carolina | October 1, 2019 | |

Texas | October 1, 2019 | Please contact the Texas Comptroller of Public Accounts - opens in new window or tab for further information. |

Utah | October 1, 2019 | Please contact the State Tax Commission - opens in new window or tab for further information. |

Prior to the effective date, you should continue to collect and remit tax in these states if required. Additional states will be added to this list at a later date.

Once eBay starts to collect tax in the above states, no action is required on your part, and there will be no charges or fees for eBay automatically calculating, collecting and remitting sales tax. The collection process will apply to all sales, whether the seller is located in or outside of the United States.

When a buyer purchases an item on eBay, and the ship to address is one of the above states, eBay will calculate and add the applicable sales tax at checkout. The buyer will pay both the cost of the item along with the sales tax. eBay will collect and remit the tax.

Sellers are not able to opt out of selling items into the states listed above or opt out of eBay automatically collecting sales tax.

1099-K forms and income tax on eBay sales

By law, sellers have to declare and pay taxes on income earned from eBay sales. We recommend checking with a tax advisor to understand your responsibilities.

If you’re a managed payments seller, and have more than 200 transactions and generate more than $20,000 in sales in a calendar year, you'll receive a Form 1099-K from eBay. This information will also be reported to the IRS and your state tax authority, where applicable.

Only managed payments sellers will be eligible to receive 1099-K forms from eBay. If PayPal or another authorized payment service processed any of your eBay payments during the calendar year, you may receive a separate form from them if your transactions meet the thresholds.

Sellers in Massachusetts and Vermont

Massachusetts and Vermont use a threshold of $600 and don’t have a transaction threshold, so if you reside in one of these states, you’ll get a Form 1099-K if your gross payments equals or exceeds $600, irrespective of the number of payments you receive.

We’ll also report this amount to the Massachusetts or Vermont tax authority as applicable. You should note that your gross payments won't be reported to the IRS unless you exceed $20,000 in gross payments and have more than 200 transactions.

For more information, read our article on eBay and Form 1099-K.

Informing overseas buyers about import charges

When you sell to buyers outside the US, import fees (including taxes and customs charges) will apply for the country you're sending the item to.

The fees are usually based on the item's price, shipping weight, dimensions, and country of origin, plus any taxes, duties, and fees from the country you're sending the item to.

Buyers are responsible for paying import fees, usually as part of clearing their parcel through customs or when they receive their item. If you offer international shipping, you can't include these costs in the item's purchase and shipping price. Make sure to let international buyers know this in your listings.

Tip

If your item's being sent using the Global Shipping Program, eBay will inform the buyer about import charges and these will be included in the order total at checkout.

Some countries and jurisdictions require eBay to collect import tax from the buyer when they pay for their order. You'll find more details in our Tax policy.

Comments are closed.